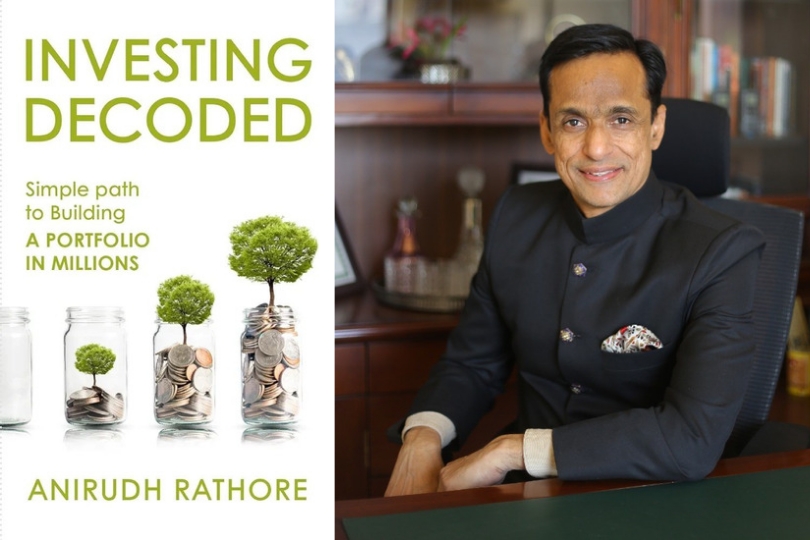

Interview with Anirudh Rathore Author of “Investing Decoded”

..on Jan 20, 2024

Frontlist: As this month marks a new beginning for many, what advice would you offer to individuals eager to start or enhance their journey in the stock market, particularly those new to investing?

Anirudh: For all new investors looking to get started in investing in stock markets and even in other assets I would like to welcome them to the most exciting , fascinating, challenging and interesting institutions of the world. Investing is an aspect of life that stays connected to all of us for our entire life. It is very important to get started quickly and clear our basic concepts of investing early. All new investors should follow an asset allocation strategy.

Within your asset allocation it is good to keep equities at the forefront of your investing because equities are productive assets and tend to outperform other assets. Fresh investors should not be in a rush to make quick gains but to look 10, 20, 30 years ahead and focus on getting consistent returns. Good things come to those who wait.

Frontlist: Shifting from a career in banking to becoming an author on investment seems like a unique transition. What inspired you to document your expertise in a book, sharing your insights on value investing and financial literacy?

Anirudh: During my banking career I was focused on the job at hand and at that time I never imagined that I would become an author one day. It was amidst the time of the second wave of covid that my businesses had been closed for over a year and then in a moment of spontaneity and impromptu that I started writing a book on investing. I knew that in spite of a flood of information available to prospective investors on the internet and media there was this palpable confusion of investors about value investing. I thought it would be a cool thing to bridge this gap and share what I had learned about this subject I had become a reasonably experienced investor over the years and knew the concerns and roadblocks that investors face in attaining financial literacy as well as comprehending the capital markets.

Frontlist: Your book, 'Investing Decoded,' seeks to demystify stock market investment for a wider audience. What advice would you offer to individuals at different stages of their careers, particularly to a 20-year-old just starting and a 40-year-old navigating the maturity of their professional journey?

Anirudh: The rules of investing are same for all age groups. A 20 year-old starting their journey is an ideal situation to make the best of compounding for the next 50 years. They should start investing at least ten percent of their earnings in the capital markets. They can increase this amount as their income increases. At such a young age an investor can have their asset allocation skewed more in favor of equity markets. Even for a 40 year-old investor beginning in equity markets is all fine. There are a lot of people who are late starters in the equity markets. At a mature age the advantage that investors have is that they have larger incomes from their careers or business. Therefore, they can invest larger sums of capital in the equity markets. Mature investors show more patience and make less impetuous decisions in the markets. As it is a major part of returns accrue to investor’s post the age of 50 as compounding starts working wonders as the years advance.

Frontlist: Given the current economic climate, what factors or trends do you foresee impacting investment decisions in the upcoming year, and how can individuals prepare themselves accordingly?

Anirudh: Domestically for India the economic climate is benign and healthy as GDP numbers are looking robust, tax collections are in an uptrend, the banking system is disbursing increased credit with the NPA issues pretty much settled. Also, inflation is moderate and RBI has given a pause to interest rates rise. The only issue is that the valuations of the Indian markets are at a premium to long term averages. Investors may have to reduce their return expectations for the upcoming year and India may see a time wise correction in the broader markets. However, pockets of value exist and the market will test the stock picking abilities of investors. Internationally the Federal Reserve Bank has indicated rate cuts over the next couple of years which is fine for India. Investors need to stick to their asset allocation strategies and that is the best way to navigate themselves for the current year.

Frontlist: In 'Investing Decoded,' you distill your two decades of experience in equity investment. What challenges did you face in translating your extensive knowledge into a beginner-friendly guide, and how did you overcome these obstacles during the writing process?

Anirudh: The idea behind the book was to break down the complexities of the market and distill them for everybody to understand. I wanted the information given in the book to be practical and useful. There are no exact or precise rules in investing. It is better to work with a range of outcomes rather than making it into an exact science.

I wrote the book in exactly the way I understand the capital markets. Before I began any chapter I put myself in the position of an investor who wanted to make sense of the markets. Also, I tried to include my personal experiences as much as I could. As a reader goes through the book they will realize that I have tried to include the major analytical and psychological tools required to be a sharp investor. Further, I have attempted to create a conversation with the reader rather than sounding academic and have given examples of how I used these tools for my personal benefit. Finally, as readers go through the book and give me positive feedback it will be an attestation of the content of the book.

Frontlist: For someone starting 2024 with a resolution to take charge of their financial future, what practical steps or habits should they cultivate to become more adept at managing their investments, inspired by the principles in your book?

First and foremost individuals need to start investing on a monthly basis and keep on educating themselves on investing. Therefore, they need to know that they also have to save regularly. It is always good to have some investing automated like a systematic investment plan. This creates a discipline in investing and those people who are very busy in their careers or businesses and cannot give too much time to investing have a process that is self-operating.

For more advanced investors I believe they should look at capital markets as a platform to make a meaningful impact in their financial life. The goal should be to create enough income from the stock markets so that it can provide more freedom to do as you please with your time and money.

Learning about the financial world and markets should be a continuous affair as it inculcates a better grasp of various asset classes and helps us decide on the correct allocation of different assets to achieve our financial goals.

Frontlist: When seeking financial guidance, there's an abundance of so-called gurus. However, what key factors should one consider before following any of them, especially given the recent news about the author of 'Rich Dad Poor Dad facing a significant $1.2 billion debt?

Anirudh: I think all acclaimed financial gurus have something to offer to investors. Usually they have a stronger emphasis on a particular financial asset as they have succeeded in a particular style of investing and hence investors can absorb some pearls of wisdom emanating from them.

It is important to remember for investors to first ascertain which aspect of finance they need help or assistance for. Finance is a vast field and includes retirement planning, estate planning, tax planning, debt management and investment advice in real estate, stocks, commodities etc. A guru that has succeeded in a particular field and can articulate concepts with clarity could be followed. Also, investors need to understand that no one guru is a master of every financial field. So following a few of them would be a better approach.

Robert Kiyosaki has written one of the greatest financial bestsellers in the world ‘Rich Dad Poor Dad.’ He uses debt to buy income-generating assets such as real estate, businesses and investments such as gold, silver and bitcoin. Debt in itself can be a good thing if used to acquire the correct assets. However, the amount of debt should be manageable and the individual should treat the debt owed with responsibility and care.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Sorry! No comment found for this post.