Indian Online Education Company Byju Grabs $1 Billion In Funding

Indian Online Education Company Byju Grabs $1 Billion In Fundingon Apr 12, 2021

About The Study: Open banking-powered payment offerings have been available in some markets since 2018, but the pandemic drove many consumers to try these solutions for the first time — and there’s no going back. In the Open Banking Report, PYMNTS examines open banking’s rise as merchants and payment services providers worldwide tap into such options to offer secure, seamless account-to-account payments.

Source: pymnts.com

$1 Billion In Funding

Byju

Covid-19

Education

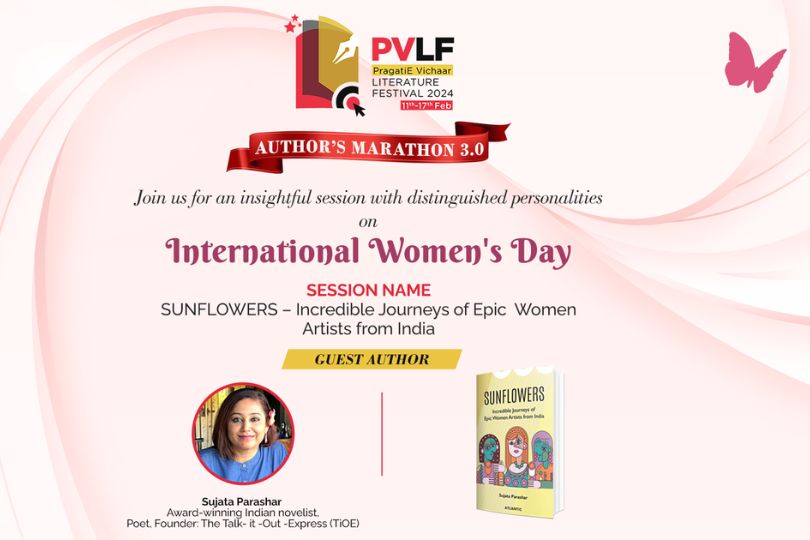

Frontlist

Frontlist Education

Frontlist India news

Frontlist Latest news

Frontlist News

Indian Online Education Company

online education

wonders to bolster the industry of online educatio

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Sorry! No comment found for this post.