Frontlist | IMPACT OF COVID-19 ON THE INDIA BOOK CONSUMER

Frontlist | IMPACT OF COVID-19 ON THE INDIA BOOK CONSUMERon Jul 16, 2020

EXECUTIVE SUMMARY

The COVID-19 crisis is an unprecedented time, suspending large parts of human normalcy and disrupting global economies, including India’s. The Indian publishing industry has experienced difficult times with the advent of the pandemic and subsequent complete lockdown. With the ease in the lockdown situation, the publishing industry is focused on book sales and preparing for post-lockdown by seeking answers which can strategically fortify their business needs.

As a result Nielsen Book India has undertaken an initiative to provide meaningful consumer insights to the publishing industry. The research aims to understand book reader’s behaviour and engagement during and after lockdown.

Nielsen Book conducted an online survey of 1,084 Indian adults (with a ratio of 60:40 female/male) to examine the impact of reading and buying behaviour on leisure books (excluding academic books) in India. The survey was conducted from 14 May to 7 June 2020. It was disseminated to publishers, media companies, etc. and across social media where followers used the snowballing technique to reach other respondents. It should therefore be assumed that the majority of respondents are likely to be keen book readers and buyers as per the methodology used to conduct the survey. The responses from employees working in publishing, book retailing and market research companies are excluded from the study.

CHANGE IN TIME SPENT READING AND OTHER ACTIVITIES

The report shows that two-thirds of book readers say they are consuming more books since lockdown began. Before lockdown, Indian book readers read books or listened to audiobooks for an average of nine hours per week. Since lockdown, this has increased by seven more hours a week.

Two out of five respondents spend more time reading print books, similarly one in two spend more time reading e-books and one in five listening to audiobooks.

FORMATS USED FOR READING/LISTENING

On average, print books accounted for two-thirds of book reading before lockdown and respondents predicted that print books would remain nearly as important even after lockdown. A marginal improvement was also noticed in the consumption of other formats.

Before lockdown, men tended to spend comparatively more time than women reading print books and listening to audiobooks while women are shifting slightly towards digital books after lockdown. Across all ages, readers are reading majorly print books while it was noticed that the ≥35 years age group (older readers), are marginally consuming more e-books after lockdown.

POPULAR GENRES DURING PANDEMIC

Women are more likely than men not to have changed their fiction reading interests since the outbreak of COVID-19, with both sexes more interested in Crime/Thrillers and Literary/Classic Fiction, alongside Historical Fiction (men) and Romance (women).

Copyright © 2020 The Nielsen Company (US), LLC.

Historical/Political Biographies followed by Self-Help/Personal Development and Self-Study (learning new languages, etc.) are the most popular amongst non-fiction readers.

Respondents with children aged 0-8 are especially likely to have changed their genre interests when buying for children since the outbreak of COVID-19, with increased interest in Picture Books, Activity Books and Animal Stories. Those with children aged 9-17 are more interested in buying Spy/Detective/Mystery Stories, Fantasy and Classic stories.

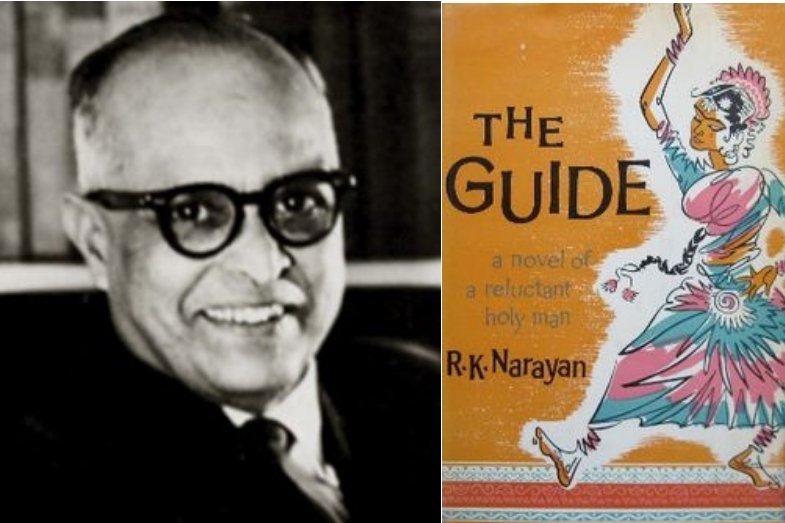

AUTHOR AND LANGUAGE PREFERENCES

English is the most preferred language for reading followed by Hindi. One in three male readers prefers to read in Hindi. Younger consumers (≤34) are reading more titles from international authors compared to older readers (≥35).

Two thirds of respondents prefer both international as well as Indian authors while one in 11 respondents prefers only Indian authors.

METHODS FOR DISCOVERING AND CHOOSING BOOKS

Recommendations from friends/relatives followed by media articles/reviews and general browsing on bookseller websites were the most influential factors on discovering books pre and post lockdown.

Female readers are more likely than men to seek out recommendations from friends/relatives and read media articles/reviews. Meanwhile, male readers like to discover books by browsing on bookseller websites and looking at bestseller sections.

CHANGE IN SOURCES USED FOR BUYING BOOKS

Purchasing online followed by physical bookstores and then home delivery were the most preferred options for buying books post lockdown.

Six out of 10 respondents expect to buy books through physical stores and seven out of 10 through an online bookshop after the lockdown is lifted, with the proportion higher than before lockdown in each case, but more so for online than in-store. Respondents also think they will make more use of home delivery after lockdown than before.

PURCHASING BEHAVIOUR FOR PAPERBACK BOOKS

Fifty percent of fiction readers and forty percent of non-fiction readers prefer the price point of INR200-INR400 when purchasing paperback fiction and non-fiction titles.

If you would like to request a copy of the report please email:bookindia@nielsen.com

ABOUT NIELSEN BOOK

Nielsen Book provides a range of services to the book industry internationally, aiding the discovery and purchase, distribution and sales measurement of books. We are proud to run the ISBN and SAN Agencies for UK & Ireland as well as providing search and discovery services for booksellers and libraries. Our electronic trading solutions, including Nielsen PubEasy, help everyone involved in the book supply chain trade more easily and our Research services provide retail sales analysis for both print and e-books alongside research from our Books and Consumers Survey. If you would like to know more visit: www.nielsenbook.co.uk

Copyright © 2020 The Nielsen Company (US), LLC.

ABOUT NIELSEN

Nielsen Holdings plc (NYSE: NLSN) is a global measurement and data analytics company that provides the most complete and trusted view available of consumers and markets worldwide. Nielsen is divided into two business units. Nielsen Global Media, the arbiter of truth for media markets, provides media and advertising industries with unbiased and reliable metrics that create a shared understanding of the industry required for markets to function. Nielsen Global Connect provides consumer packaged goods manufacturers and retailers with accurate, actionable information and insights and a complete picture of the complex and changing marketplace that companies need to innovate and grow.

Our approach marries proprietary Nielsen data with other data sources to help clients around the world understand what’s happening now, what’s happening next, and how to best act on this knowledge.

An S&P 500 company, Nielsen has operations in over 100 countries, covering more than 90% of the world’s population. For more information, visit: www.nielsen.com

Copyright © 2020 The Nielsen Company (US), LLC.

Author

Consumers

Covid-19

Frontlist

Frontlist News

India

Indian Book Consumer

Indian Book market

Indian publishing industry

Latest Findings

Latest report

Latest reports

Neilsen Book

Paper Back Books

Publishers

Writers

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Sorry! No comment found for this post.