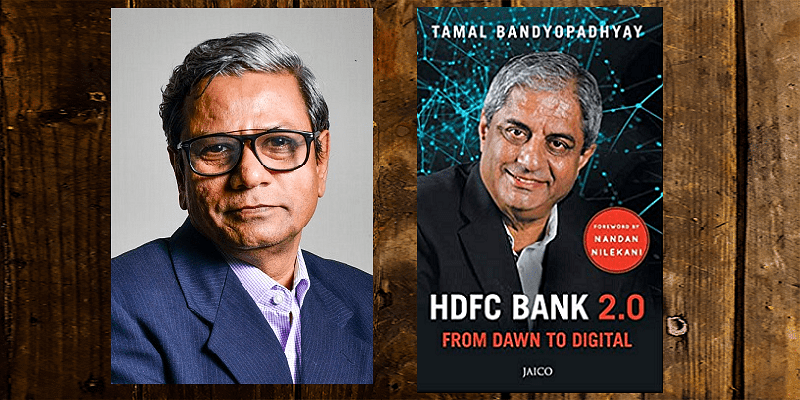

Frontlist | Author Tamal Bandyopadhyay on the book ‘HDFC Bank 2.0’

Frontlist | Author Tamal Bandyopadhyay on the book ‘HDFC Bank 2.0’on Jan 07, 2021

Tamal Bandyopadhyay’s book HDFC Bank 2.0: From Dawn to Digital has been shortlisted for the Gaja Capital Business Book Prize of Rs 15 lakh. Here are his insights on storytelling in business.

Tamal Bandyopadhyay is the author of six books, including HDFC Bank 2.0: From Dawn to Digital. The book has been shortlisted for the annual Gaja Capital Business Book Prize, which honours authors who chronicle the spirit of entrepreneurship in India. With a prize money of Rs 15 lakh, the award is regarded as the biggest business book award in India. Tamal has also been a bank advisor, and his other books are From Lehman to Demonetisation: A Decade of Disruptions, Reforms and Misadventures; Bandhan: The Making of a Bank; Sahara: The Untold Story; Pandemonium: The Great Indian Banking Tragedy; and A Bank for the Buck. The shortlisted book begins with Aditya Puri’s visit to Silicon Valley in 2014, which spurred his decision to transform HDFC Bank. A series of town hall meetings was held across India to explain the vision of digital transformation, and several startups were engaged with, such as Niki.ai and Senseforth. In storytelling fashion, Tamal describes how other initiatives by the bank moved the needle on platformisation and marketplaces. The shift from “lifecycle to lifestyle” bank was spurred by the vision of becoming a “financial experience” and not just a bank. Here is an excerpt of the interview with him: You’ve written two very diverse books – Sahara and HDFC Bank 2.0. What were the challenges in writing such different books? Tamal Bandyopadhyay: Oh, they are as different as chalk and cheese. The challenges have been very different. HDFC Bank 2.0: From Dawn to Digital is the story of the transformation of India’s most valued bank – from a financial intermediary to a market place. Sahara: The Untold Story is the story of India’s largest shadow bank, mired in controversies and protracted battles with both the banking, as well as market regulators. Incidentally, the Sahara India Pariwar slapped a Rs 200 crore defamation suit against me to stop the publication of the book. It was fought at Calcutta High Court before we reached an out-of-court settlement. A book named Sue the Messenger has a chapter on this fight. What was the most fulfilling part of writing the HDFC Bank 2.0 book? TB: As an author, my role is to tell a story. This is a wonderful story. This bank, the largest in the private sector, is a child of economic liberalization. In many ways, it is different from other banks. It does very ordinary things but achieves extraordinary results. This is also a story of entrepreneurship. As an author, I have tried to tell that story. Going by the response from the readers, I think they are enjoying reading it. As an author, that’s what I look for. Were you able to say everything you wanted in the book? What would you add now if you could? TB: In some sense, no book is complete, particularly when it is on an organisation which is in a growth phase. Every day is a new day and there are new challenges and opportunities. If one is writing a biography of an entity which has passed its prime, the story is already over and there is nothing much to add. But this is not the case with a living organisation. If I write the book today, there will be many new things to add – Aditya Puri stepping down, and the task before the new boss Sashi Jagdishan; the bank being pulled up by the regulator for glitches in digital banking, and so on. That’s true with every living organisation. What is your next book about? TB: My sixth book in the past eight years is Pandemonium: The Great Indian Banking Tragedy. This has a very vast canvas – the banking mess in India, why it has happened, and the way forward. It covers many aspects: the crisis in the non-banking financial sector, the state of affairs in public sector banks, the war against bad loans, the growing incidents of frauds, the activism of investigative agencies, the progress of insolvency code in the recovery of bad loans, misgovernance and fall of certain stalwarts in Indian banking, and the role of the banking regulator. Beyond words, there is a series of charts that tell the story of Indian banking. What are your favourite or inspiring books about Indian business? TB: I am not a voracious reader. Some of the books I have enjoyed reading in recent months include Verghese Kurien’s I Too Had a Dream, James Clear’s Atomic Habits, Rashmi Bansal’s Connect the Dots, and a pretty old book, Nissim Nicholas Taleb’s Antifragile. They are not about Indian business alone. What makes a good business story different from a case study or chronology? TB: I am a great believer in telling a story. I find case studies are generally boring. It’s not the case per se, but how it is written is important. As a reader, I want things to unfold before me like a film. What are some creative elements that appeal to readers in business books? TB: We need to tell the story in a way that the readers have no choice but to finish reading the book at one go. An eye for details is crucial for this. It does not need to have a linear structure; the story can move back and forth, there could be flashbacks. It must read like fiction. What makes a business book different from a series of long articles about the subject? TB: I don’t think they are very different. In fact, I treat each chapter like a long article. I write a 1,000-word column every week called Banker’s Trust. I have been writing this since 2007. When I plan a book, I treat each chapter like a long column. What is the importance of business leadership in the post-pandemic era, and how do books establish thought leadership in that regard? TB: The pandemic has changed many things, including our priorities in life. I know people who seldom read books are now ordering books online because we are spending more time at home (in contrast to being in the car and on a flight). There is more time to read books, watch films, and many are doing that. Is this establishing thought leadership? I don’t know. But one thing is for sure that people are looking for inspiration to meet the challenges in the new world. If your book were to be used in a business course, what advice would you give the teacher on how to leverage the material? TB: In some sense, it is a case study, but the presentation is very different. It can inspire the students; it can teach them to look at their jobs not as an employment but as entrepreneurship. And, going beyond entrepreneurship, it is a testimony to what new India can do — what can happen when the passion for excellence merges with high corporate governance. This message must be conveyed. What are your thoughts on using figures/charts/tables in business books? Why did you choose not to, though you have photographs in the HDFC Bank 2.0 book? TB: I have done that in my latest book. In fact, what nearly 1.5 lakh words struggle to say, 16 charts in the book explain brilliantly – the Indian banking mess. I am not against using charts and figures, but they must be relevant and add value. Otherwise, we run the risk of turning a book on an organisation into a typical case study, an academic exercise. As a journalist, was it easy for you to get access to the inner workings at HDFC? TB: It all depends on trust. If the other side trusts you, access does not become an issue. I am fortunate that many doors in the financial sector are open to me. This does not happen overnight. One needs to earn this. How long did it take you to write the HDFC Bank 2.0 book? Does the intention to write a book germinate over a period of time, or does it come in a flash? TB: I have written six books in the past eight years. My first book was launched on November 24, 2012, and the last on November 9, 2020. As you see, I am fairly prolific. And, book writing is one of the many things I do — it's not my only engagement. Whatever I do, I do with a certain amount of intensity. I don't take very long to write a book. Probably a year or little more, from conception to final script. Unlike poems (which I do write, in my mother tongue), ideas for books don't come in a flash. Often it's a joint venture between the publisher and me – yes, I am talking about the idea. Of course, there have always been certain ideas I am always exploring. There are many unwritten books in my closet. What are your thoughts on how the life of a print book can be extended digitally via online companions, videos, etc.? What would you like to do with the HDFC Bank 2.0 book in this regard? TB: There are books, and there are books! Some books have a long shelf life but not all. I don't believe in quickies – I research on the subject, and speak to people. I would like to believe that a book like HDFC Bank 2.0 should be read by many, and could be presented in different formats as it is an inspiring story — a story of entrepreneurship, a story of what economic liberalisation can do. What are your words of advice for the aspiring entrepreneurs in our audience? TB: I am not qualified for advising, but here is one suggestion. For being an entrepreneur, you don't necessarily have to start a new business; you can be an employee, and at the same time, an entrepreneur. HDFC Bank story is this story of entrepreneurship. What are some tips you would give for those writers who want to write a business book that is well-researched, as well as engaging? TB: Just one tip: tell an absorbing story, backed by research. Even great research cannot make a book worth reading unless we tell the story well. And, if only the bankers or finance professionals read a book on finance, the author is a failure. Similarly, business books must be read by non-business people. This is possible only when the writers believe in simplicity. What would you do with the prize money if you were to win the award? What would the honour mean to you as well? TB: It may sound a cliché, but I mean every word of what I say: if I win the award, I am going to use a substantial part of it for a cause. Along with a few others, I am planning to set up a trust to help children of underprivileged people for education in a small town in West Bengal from where I come. It has been on the drawing board for years, but now the pandemic has made us believe that we must bite the bullet without delay. We are planning it for next financial year. One caveat though: even if I don't get the prize money, I am committed to this project. It will take off next year. What does the honour mean for me? I don’t write books for awards. I am happy if readers enjoy them. If an award comes on my way, that’s a bonus! Source: Your Story

Authors

Entrepreneurship in India

Frontlist Book News

Frontlist India news

Frontlist Indian Author News

Gaja Capital Business Book Prize

HDFC Bank 2.0

Indian authors

New Book News

New Book News Frontlist

Tamal Bandyopadhyay

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Sorry! No comment found for this post.